We are seeing a shortage of rentals in our market. The supply is dwindling and the prices are going up.

Since the beginning of March, our supply of active rentals in the Phoenix Area has been reduced by about 15% according to the Cromford Report.

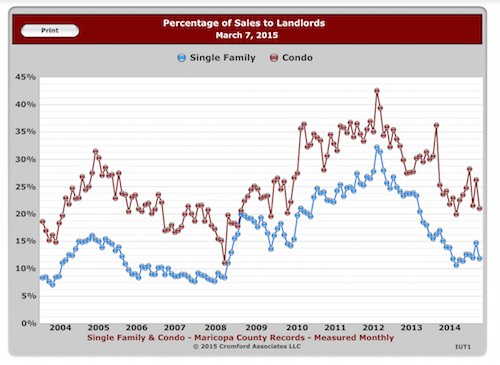

This may be great news for investors looking to buy and hold because the supply is less than the demand.

March 30 – The situation with single family rentals continues to get even more extreme. Today there are just 1,763 active listings on ARMLS, down another 15% since the beginning of the month and down 25% from this time last year. This is 24 days of supply.

The average lease rate is up to $2,106 per month (up 41% from $1,710 last year). The average days on market is down to 33 (it was 40 last year).

There are 988 condo rentals active, down from 1,347 at the same time last year, which is a drop of 27%. This is 54 days of supply

The average lease rate is up to $1,655 per month (up 13% from $1,461 last year). The average days on market is down to 39 (it was 45 last year).

Affordable homes to rent or buy are both becoming much harder to find. However there is still plenty of choice in the upper price ranges for both lease and purchase.

The Cromford Report

For aspiring homeowners with a lower purchasing power, they can no longer afford to sit on the sidelines because with the rising lease rates their housing expenditure is likely to go up, whether they choose to lease or buy. At least with a purchase of a home they could build some equity.